Individual Transcripts (3-Day)

$99.00

Return Transcripts (select years)

Account Transcripts (select years)

Record of Account Transcripts (select years)

Wage & Income Transcripts (select years)

Tax Payer First Name

Enter your text

Tax Payer Last Name

Enter your text

Social Security Number

Enter your text

Date of Birth

Please choose a date

Street Address

Enter your text

City

Enter your text

State / Province

Enter your text

Zip / Postal Code

Enter your text

Country (if other than USA)

Enter your text

E-mail Address for E-Sign

Enter your text

Cell Phone for SMS E-Sign

Enter your text

In stock

Product Details

For Mortgage Processing

Most mortgage underwriters will only need that last 2 to 4 years of the Return Transcripts from the Borrower.

Instructions

- Select the Years of the Transcripts that you wish us to retrieve.

- Fill in all of the required fields for the Tax Payer. These will be inserted into the IRS Authorization Form 8821. This form gives us authority to retrieve Transcripts from the IRS for the Tax Payer.

- Enter the Tax Payers email and/or mobile phone. We will use this to send a signature request so that they can sign the IRS Form 8821.

- A fter they sign the IRS Form 8821, then we will start the process of retrieving the transcripts from the IRS.

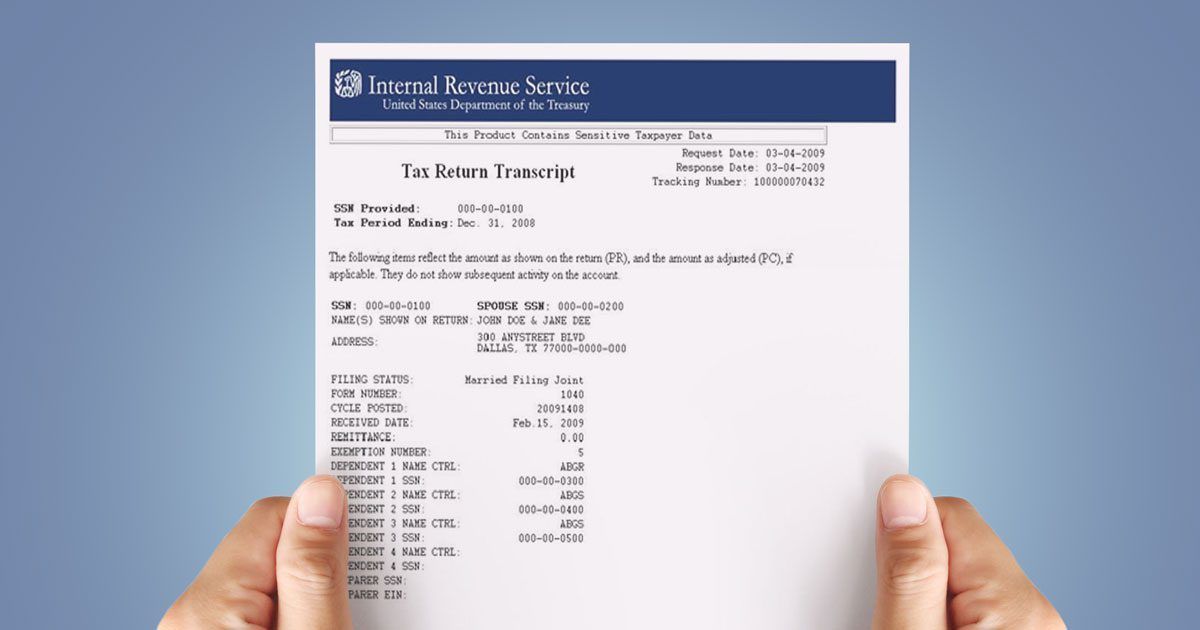

IRS Individual Transcripts

- Return Transcripts: Shows information from the original Form 1040 tax return filed with the IRS.

- Account Transcripts: Shows basic data such as filing status, taxable income, and payments.

- Record of Account Transcripts: Combines the information from the Return & Account transcripts

- Wage & Income Transcripts: Shows wage and income information such as Forms W-2, 1098, 1099 and 5498.

Individual Transcripts (3-Day)

Display prices in:

USD